It’s not an academic question.

It’s not an academic question.

Readers of my recent blogs will know that I believe staying competitive in a Cloud-first world will require additional capitalization for many Microsoft partners.

As an owner, if you wish to secure that capital you must present a viable investment thesis to potential funding sources. In other words, you must convince potential investors that you can generate an acceptable return on their invested capital, as well as yours.

In practice, I am seeing 3 main ways to make that case:

- Rapid growth and market share gain. You have a strong Cloud-based offering that is producing recurring revenue growth of say 30% or higher annually but could scale even more rapidly with a capital injection (remember the goal is to capture share before someone else does). Profitability is less important than a healthy gross margin structure, because you’re continuously investing in growth and refining the offer.

- Aggressive SaaS pivot. You have strong recurring revenue already (for example maintenance on your own IP), that you want to convert to Cloud subscriptions because they have a longer life expectancy and are therefore more valuable. You also can take share from others if you were to be better funded for aggressive customer acquisition.

- Market footprint consolidation. You have a strong market position, which can become dominant through acquisitions of competitors and a consolidation of their customer bases. In this case, the goal is to achieve better scale economies, and capture a price premium from customers because of your dominant market position. This expands both revenue and profitability levels.

In some situations, these theses can be combined to make an even stronger investment case. But the critical thing is to understand how you will create substantial gains in shareholder value, both for yourself and the provider of capital.

How strong do those shareholder value gains have to be? That requires a deeper conversation …

Contact me if you’d like to have that discussion.

In pursuit of

In pursuit of

When it comes to

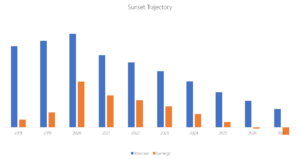

When it comes to  Survey findings are now available for the latest CloudSpeed survey, with over 100 Partners sharing their anticipated sales, traditional seat migrations, workload attach rates, and resourcing requirements to name a few.

Survey findings are now available for the latest CloudSpeed survey, with over 100 Partners sharing their anticipated sales, traditional seat migrations, workload attach rates, and resourcing requirements to name a few. How prepared are Microsoft Partners to fully capitalize on the fundamental market changes that are driving demand for Dynamics 365 Business Central? What key business levers are the most important to achieve sustained profitability? What lessons can be learned from other Partners in the field today? How can the entire ecosystem fully exploit this market opportunity?

How prepared are Microsoft Partners to fully capitalize on the fundamental market changes that are driving demand for Dynamics 365 Business Central? What key business levers are the most important to achieve sustained profitability? What lessons can be learned from other Partners in the field today? How can the entire ecosystem fully exploit this market opportunity? In this digital age, the IT services market is not working effectively for any stakeholder group – Customers, IT Professionals, IT Resellers, IT Vendors, and Distributors alike. Each remain exposed to critical risks and fail to realize the full promise of digital transformation.

In this digital age, the IT services market is not working effectively for any stakeholder group – Customers, IT Professionals, IT Resellers, IT Vendors, and Distributors alike. Each remain exposed to critical risks and fail to realize the full promise of digital transformation.

Having worked with Dynamics Partners for a decade now, I believe this is a pivotal time for the channel.

Having worked with Dynamics Partners for a decade now, I believe this is a pivotal time for the channel.