One of the things that can fairly be said of many Partners in the Microsoft ecosystem is that there is an almost instinctive focus on short term business impacts.

That’s quite natural, because in the past, success in any given year was more or less the sum of the successes of each deal you did. You lived and died based on short-term project performance.

But the Cloud is different.

The Cloud business model is all about the long game.

Here’s why …

Certain investments must be made upfront, like an ante. Buying behavior has radically changed and so different marketing and sales infrastructure are needed, for starters. Customers want integrated, industry-specific solutions and so offerings must be far more “productized”. These all represent very real, and largely fixed, costs.

Revenue, however, is mostly annuitized; it comes in over time in the form of subscriptions for both products and services. The customer expects lower upfront costs, and so is reluctant to fund the large projects they once did.

This has 2 main effects:

- Operating cash flow, in the short term, is often negative.

- This deficit must be funded.

Compounding this is the fact that market share must be gained quickly. The logic here is to put a fence around as big a customer base as possible, before someone else does. Inertia more or less does the rest in terms of generating long-term profitability, as long as “core” gross margin levels are healthy.

This is why company valuations are highest for those who are posting strong recurring revenue growth, even if short term profitability is negative. In effect, technology is becoming a “utility”, and the market is rewarding those who carve out a meaningful niche for themselves as an ongoing product or service provider, rather than simple one-time project services vendors.

So in the Cloud, a focus on short term business impacts risks resulting in long-term failure.

But it is equally true that to win the long game, you must have a plan. A plan to build a solid, sustainable, defensible market position, before someone beats you to it. As part of that plan, you may also need to raise outside capital, to achieve a suitable economic outcome.

More on that in the next blog …

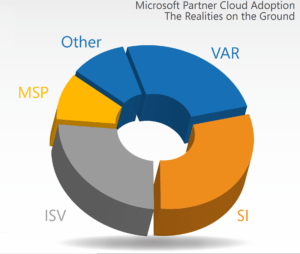

Recently completed, this year’s Study dives into the impact the Cloud has had on Microsoft Partner revenue composition, margin structure, growth rates, and company valuations. As well as the core strategies being used to monetize the Cloud opportunity.

Recently completed, this year’s Study dives into the impact the Cloud has had on Microsoft Partner revenue composition, margin structure, growth rates, and company valuations. As well as the core strategies being used to monetize the Cloud opportunity.