And by that I mean, what do want your business to be worth in the Cloud era?

And by that I mean, what do want your business to be worth in the Cloud era?

Over the last 10 weeks, I have spoken or met with several dozen Microsoft Partner owners, from all parts of the globe. I’ve asked certain core strategic and economic questions of them all. We’ve done their Cloud math, together. And I’ve learned, everyone has a different number.

Now for starters, we’re all in agreement that the Cloud is a disruptive event. Which makes it both an opportunity and a threat. And it’s upon us, now. So owners have a burning need to identify what their business will be worth in a Cloud-first world.

But among the owners I’ve worked with, the Cloud Number Range is wide. Surprisingly wide, in my opinion.

In my travels, I’ve found certain key things tend to drive what your Cloud number ends up being:

- The market segment you pursue. Or put another way, the demand wave you chose to ride. Each segment will tend to have its own inherent potential.

- How crisply you can define your offering, and why customers would buy it. Specifically, what quantifiable business risk are they avoiding by using your offering, or what economic advantage will they achieve?

- How aggressively you are prepared to pursue your chosen market segment. Put simply, the more customers you capture before someone else does, the more your business will be worth. If your Cloud revenue is not growing by at least 20% per annum, you’re in effect losing share to someone else. Never a cause for happiness.

- Your ability to raise the capital needed to aggressively grow your customer base. Unlike the traditional business model, the strong evidence is that you cannot effectively “bootstrap” a high-value Cloud business.

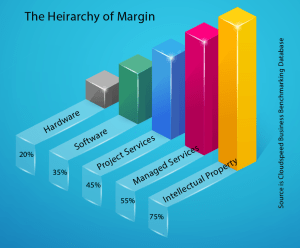

- The degree to which you can wrap managed services or “subscribeable” IP around Microsoft offerings. Because they are both recurring revenue streams, and generally deliver higher margins than one-time project services, the valuation multiples you achieve are correspondingly higher.

Want to do your own specific Cloud math? Want to identify your Cloud number?

Let me know …